“Significant Uptick” In M&A Rumors Observed In News Cycle Ahead Of 2025

By Zero Hedge

Goldman Sachs analysts have noted a “significant uptick” in merger and acquisition rumors in the press over the past six weeks. The investment bank forecasts positive M&A growth trends over the next 12 months, signaling a potential rebound in dealmaking activity.

Analysts Matt Michon and Hannah Taylor penned a note Wednesday to clients about the surge in M&A headlines.

“In the last six weeks, there has been a significant uptick in M&A “rumours” relative to the prior three-quarters so hopefully an encouraging sign that corporate activity is picking-up…!” they said.

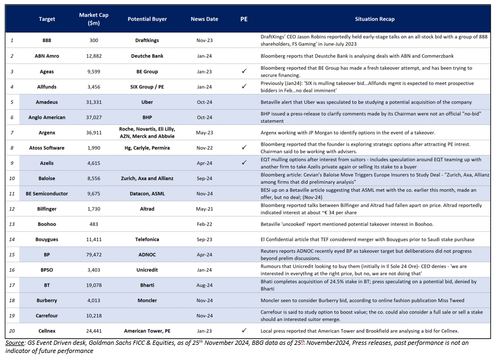

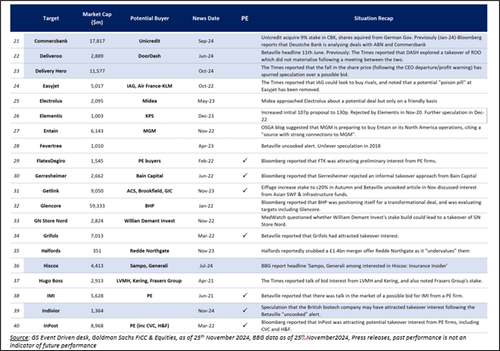

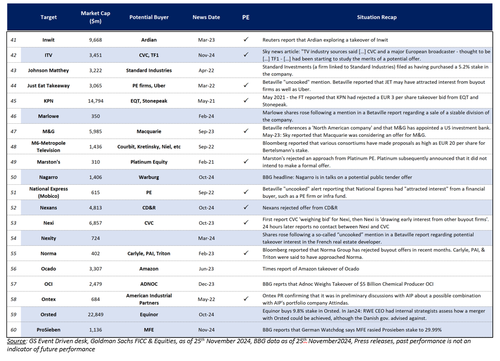

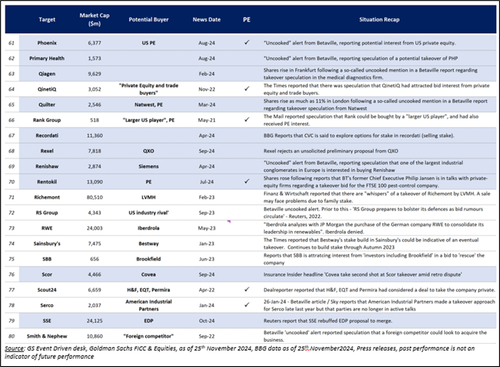

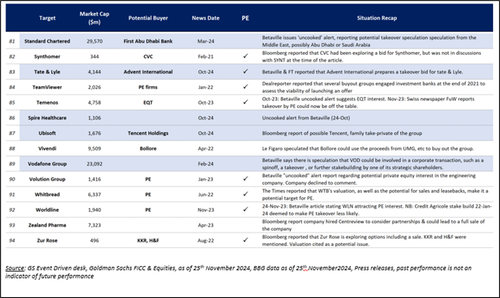

The list of companies below is part of the desk’s M&A monitor, which shows “potential M&A situations reported through the press” and also “highlighted in blue are those with news updates since our last note.” A list of failed M&A approaches was also recorded.

Most recent M&A headlines…

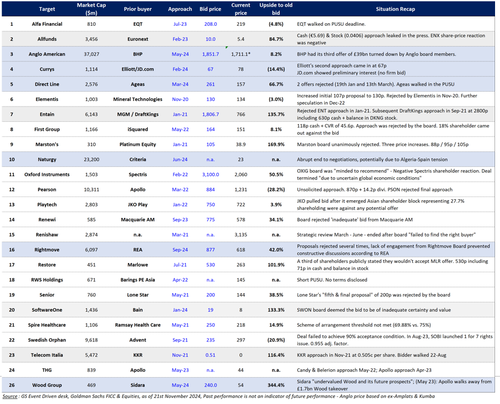

Failed M&A approaches.

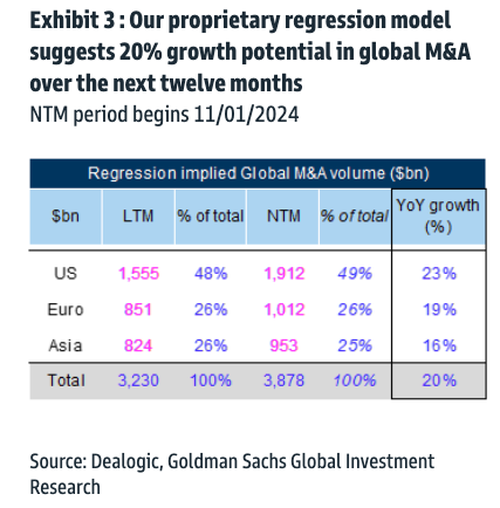

In a separate but recent note, Goldman analysts James Yaro and Richard Ramsden told clients that internal leading indicators “forecast 20% M&A growth over the next twelve months.”

The latest remarks from the FOMC Minutes suggest that Fed officials are leaning toward a more gradual interest rate-cutting cycle. One that could certainly provide relief to corporates…